TRADING STRATEGIES

While the current version of the model uses AI, next versions of the model will deploy significant improvements including the use of machine learning and deployment across a next-generation technical stack including an in-memory database (like MongoDB, KDB, ParExel, or McObject) and software defined memory through Kove. We have applied these same concepts and technologies to a real-time risk solution deploying a monte carlo simulation that executed over 837 million transactions per second on a 4 server COTS grid (see Kove-McObject-Fultech Real-Time Risk Solution). While the current model focuses in the credit space, these same concepts can be applied to other asset classes (see IWM Equities Strategy) as well and combined with a machine learning approach applied to the model input components to optimize them based on market conditions will produce market transformational opportunities.

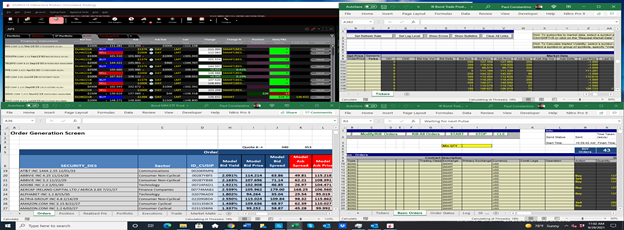

Live Electronic Trading Model Screenshot

Delta Neutral IWM Equities Strategy

Coming soon!

Demonstration of Order Entry Console Paul Constantino

AI-based, ETF Arbitrage Trading Strategy in high grade corporate bonds, presented by Quantiverse-ai

This video highlights our ground breaking disruptive strategy ETF Arbitrage Trading Strategy currently being deployed in the ETF LQD, a 9 Trillion USD high grade corporate bond market, and the IWM ETF, which is the well known Russell 2000 equities index. Our equity curve and ROI are phenominal, with drawdowns less than 3% with no losing months. For more information, please contact frederick.weiss@quantiverse-ai.com for more information and a live demo with our Portfolio Manager.

Our view on risk

IG Bond trading Strategy demonstration – in process